TAYLOR MADE RESOURCES

free RESOURCES JUST for you

Running a small business is hard enough—you shouldn’t have to figure everything out on your own. That’s why I’ve pulled together my favorite free tools, helpful guides, and trusted resources to make managing your finances just a little bit easier.

Whether you're DIYing your bookkeeping or just trying to stay organized, these are the exact tools and tips I share with my clients—and now, they’re yours too!

What you'll find here:

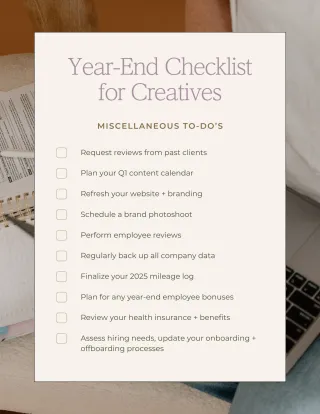

Freebies made for you: Grab my most popular downloads like the Year End Checklist for Creatives freebie and other tools built to simplify your money life.

Relay referral link: My favorite small business banking platform—perfect for separating finances and managing cash flow with zero monthly fees.

QuickBooks Online referral link: Trusted, powerful bookkeeping software with features that grow with your business (and yes, I can help you learn it!).

Recommended tools + resources: From spreadsheets to software, find my go-to recommendations for making finances more manageable—no fluff, just what works.

december's FREEBIE

Year end checklist for creatives

If year-end always sneaks up on you (and let’s be honest… it always does), this free checklist is your new best friend. I created it to help small business owners wrap up their 2025 finances with clarity, confidence, and zero overwhelm. Inside, you’ll find every task you need to complete before tax season hits — all broken down into simple, doable steps that won’t make your eyes glaze over. Whether you DIY your bookkeeping or outsource it, this checklist keeps you organized, compliant, and ahead of the January rush.

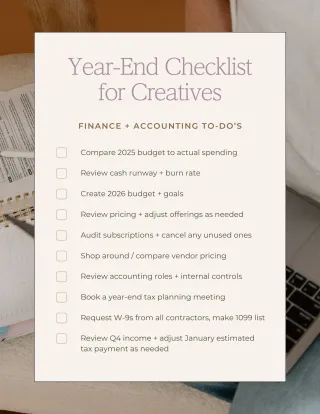

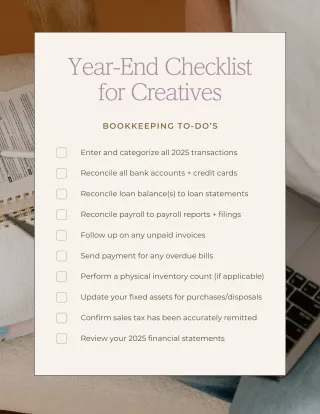

Here’s what you’ll learn inside:

KNOW EXACTLY WHAT TO DO BEFORE THE YEAR ENDS

This guide walks you through every important task — from bookkeeping cleanup to tax prep — so nothing falls through the cracks during the busiest time of year.

AVOID COSTLY MISTAKES AND MISSED DEDUCTIONS

When you follow the checklist step-by-step, you’ll catch errors early, stay IRS-compliant, and give yourself the best chance at keeping more of your hard-earned money.

START 2026 WITH CLEAN BOOKS & ZERO PANIC

No more scrambling in January! This freebie helps you organize documents, reconcile your accounts, and set up systems so tax season doesn’t hit you like a brick wall.

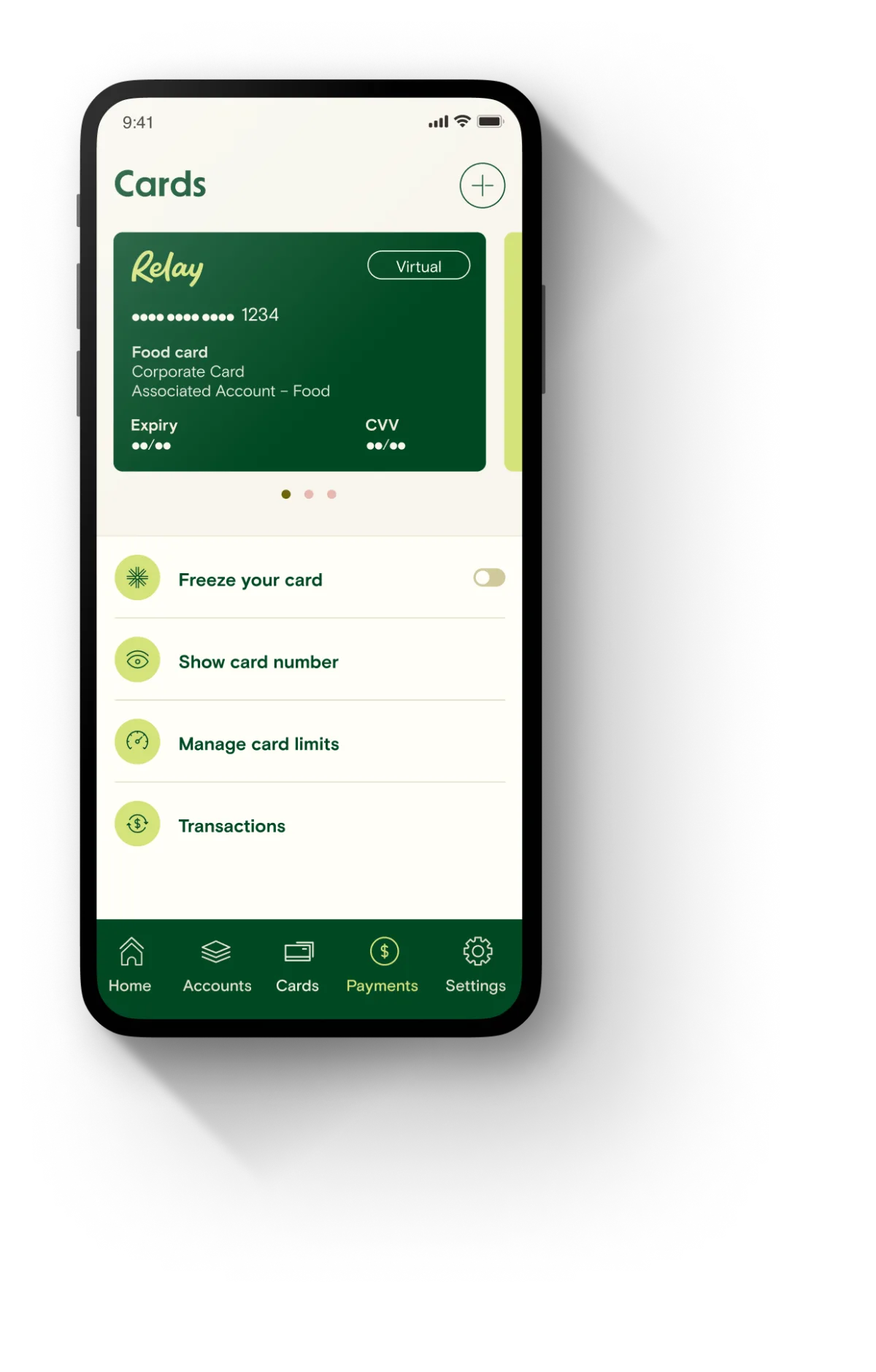

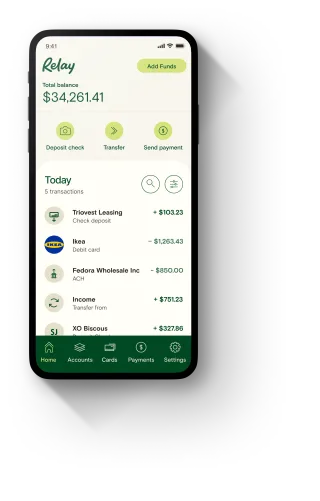

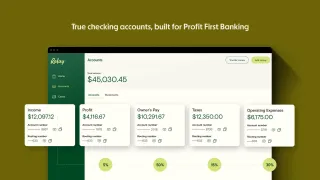

MY FAVORITE BUSINESS BANK

RELAY FINANCIAL

Managing cash flow is so much easier when you have a business bank account that’s actually built for business owners. Relay Financial is a free, online banking platform designed specifically for entrepreneurs—and it's the one I recommend to all my clients. With features that support real cash management (not just basic banking), Relay helps you stay organized, separate your finances, and stop guessing where your money is going.

Truly business-friendly (and totally free)

Relay has no account fees, no minimum balance requirements, and no sneaky surprises. You can create up to 20 checking accounts to organize your money for taxes, payroll, savings, and expenses—all in one dashboard.

Perfect for cash flow management + Profit First

Whether you're following Profit First or just trying to make sure you’re not spending your tax money on subscriptions, Relay lets you assign income into different accounts automatically so you can see exactly where every dollar is going.

Built to integrate with bookkeeping tools

Relay syncs seamlessly with QuickBooks Online, making your bookkeeping cleaner and more accurate. Plus, you can securely give your bookkeeper access without handing over your login info (yes, please!).

THE GO-TO TOOL FOR SMALL BIZ BOOKKEEPING

QUICKBOOKS ONLINE

When it comes to managing your business finances, QuickBooks Online is the gold standard—and it’s what I recommend to most of my clients and course students. It’s powerful, flexible, and built to grow with your business. Whether you're brand new to bookkeeping or ready to level up from spreadsheets, QBO gives you the tools to stay organized, track your income and expenses, and always know where your money stands.

All-in-one platform for tracking your finances

QuickBooks Online keeps everything in one place—income, expenses, receipts, mileage, reports, and more. You can connect your bank accounts, send invoices, and even track your sales tax or 1099 payments without needing five different tools.

Designed for business owners (not just accountants)

While it has powerful features, QBO is also super user-friendly once it's set up correctly. You don’t have to be a numbers person to use it—and with the right guidance (👋 hello Office Hours Club or Numbers Made Simple), you’ll be navigating like a pro in no time.

Makes tax season so much easier

With clean, categorized books and built-in reports, you’ll always have the numbers your tax pro needs—without scrambling or second-guessing. It’s the kind of tool that helps you stay ready all year, not just in April.

View our Privacy Policy and Terms and Conditions here. © 2025. All Rights Reserved.